How Lead Flow Analytics Can Help Increase Conversions To SQLs & Improve ROI

Dumpster Diving for Opportunities In Your Lead Trash Bin

TLDR: On average, less than 4% of leads reach SQL, many more end up in a recycle bin for future nurturing and the vast majority stagnate with no user engagement for long periods of time. Rather than exclusively look at spend on new lead gen as a way to drive new pipeline, putting unsuccessful leads (whether in the remarket pile or idle) through custom nurture tracks can drive zero-cost conversions to opportunity.

A Look At The Rear View Mirror

Businesses are forward-looking. This upcoming year, next quarter, next month. We are in planning and execution phase all the time to meet and exceed our business goals. Past campaigns and investments are studied for ROI, and then done and dusted so we can focus on extracting the most out of the next marketing spend. While it is normal and even prudent for organizations to look ahead, it helps to look every once in a while in the rear view mirror and see if there are things of value that we may have left behind in our journey forward.

Maximize ROI of Marketing Spend

Marketing spend ranges from 10-25% of revenues for growth companies, per the Marketing Leadership Council and a big portion of that goes towards lead generation. Yet only a small percentage of these leads convert. If this lead flow can be understood and optimized, it can directly improve pipeline coverage and revenue attainment.

Rather than exclusively look at spend on new lead gen as a way to drive new pipeline, any efforts towards improving the ROI of prior sunk investments is a worthwhile exercise considering it costs nothing in new dollars. With some focused efforts, the marketing ops team can set up customized programs for all stale and/or recycled leads with the goal of resuscitating some of them back to MQL and SQL in the future.

We recently completed an analysis of a customer’s RevOps processes, specifically their lead to opportunity conversion (see program here) where we discovered a high percentage of idle leads and rejected MQLs that could be revived into future opportunities. Below are some of our findings specific to these failed leads. For privacy reasons, all sensitive data is anonymized but the key insights we uncovered may still provide value to our readers.

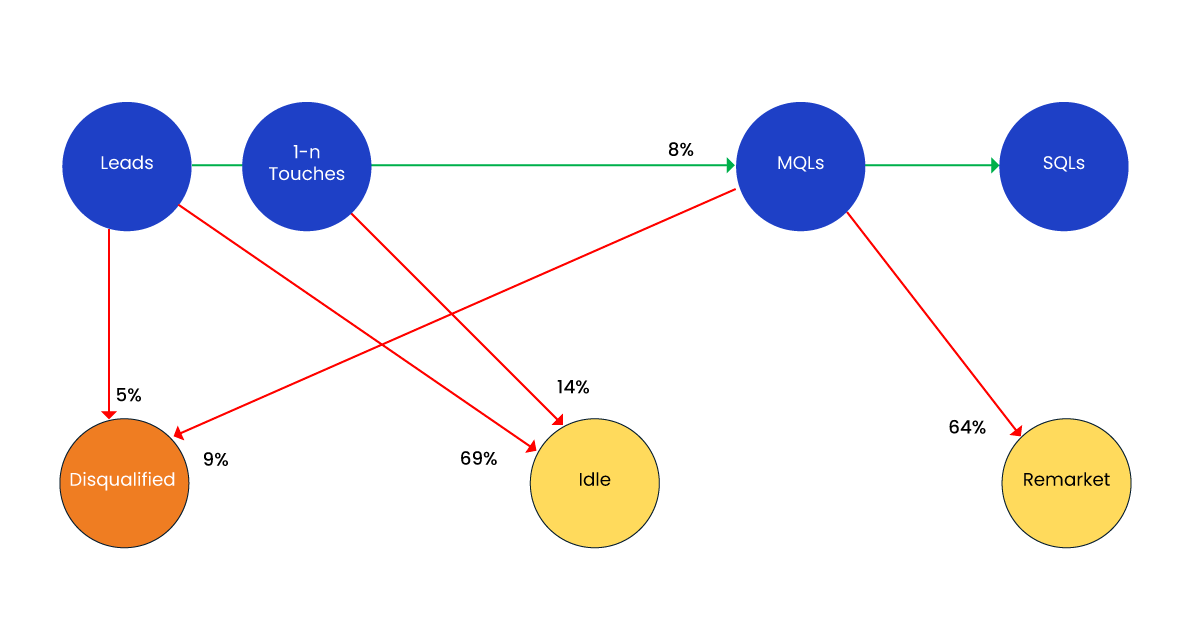

Lead Nurture Flow

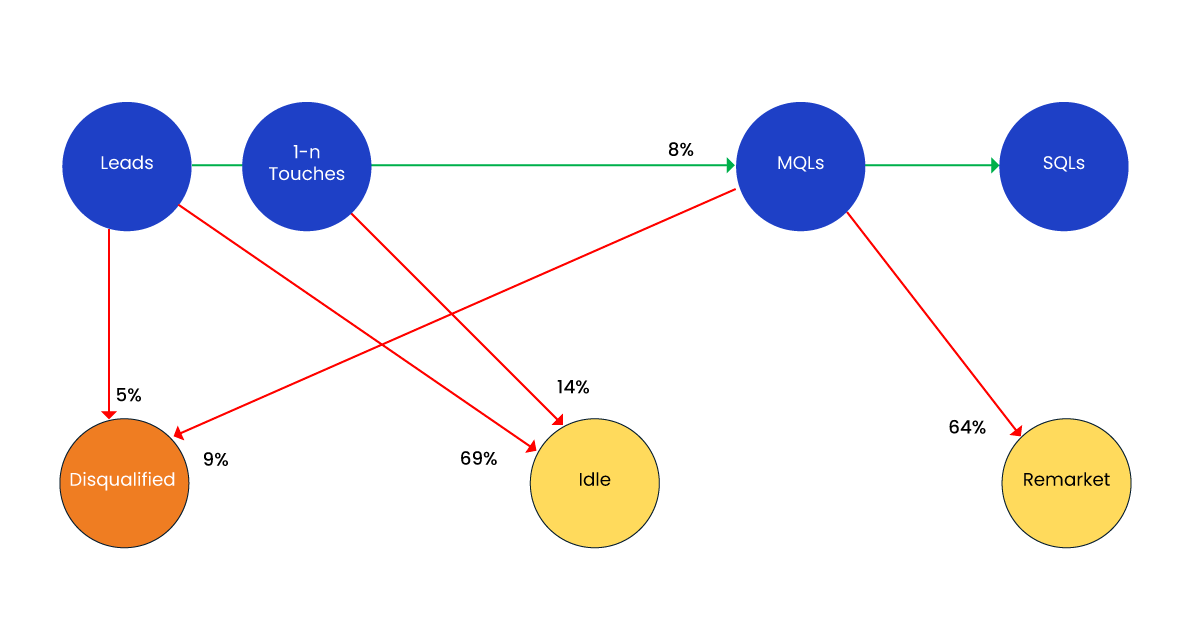

The BigLittle RevIntellect product was used to study the customer’s Lead to Opportunity Engine and visualize the flow of leads to MQL, SQL and closed won, as well as to any other states. The following flowchart captures the customer’s current lead flow within marketing:

- Due to the nature of their business and their reliance on high-volume-low-conversion marketing channels like events, their lead to MQL ratio was only around 8%.

- 64% of their leads ended up in a ‘Remarket’ bin after reaching MQL.

- 83% of their total leads were sitting ‘Idle’ with no recent response to the company’s nurturing programs. Of this, 14% had stopped responding after 1-n touches, while 69% had not engaged at all.

- 5% of leads were disqualified immediately, and another 9% of MQLs subsequently due to incorrect or incomplete data.

The customer was interested in identifying ways to (a) reduce lead flows into the Remarket and Idle bins above and (b) find ways to extract future opportunities from them.

Remarketed leads

When MQL leads are rejected by SDR sales at qualification time, they are set in status to a Remarket state. Our analysis uncovered the following rejection reasons:

| Rejection reason | % of Remarketed leads | Recovered MQLs |

|---|---|---|

| Unable to reach | 26% of Remarket leads | 0% |

| No pain at this time | 18% of Remarket leads | + 2.6% MQLs |

| No budget at this time | 17% of Remarket leads | + 1.1 % MQLs |

| Already have a solution for this pain | 13% of Remarket leads | + 1.8% MQLs |

| Not a decision maker or influencer | 11% of Remarket leads | + 0.3% MQLs |

| Other | 15% of Remarket leads | + 0.2% MQLs |

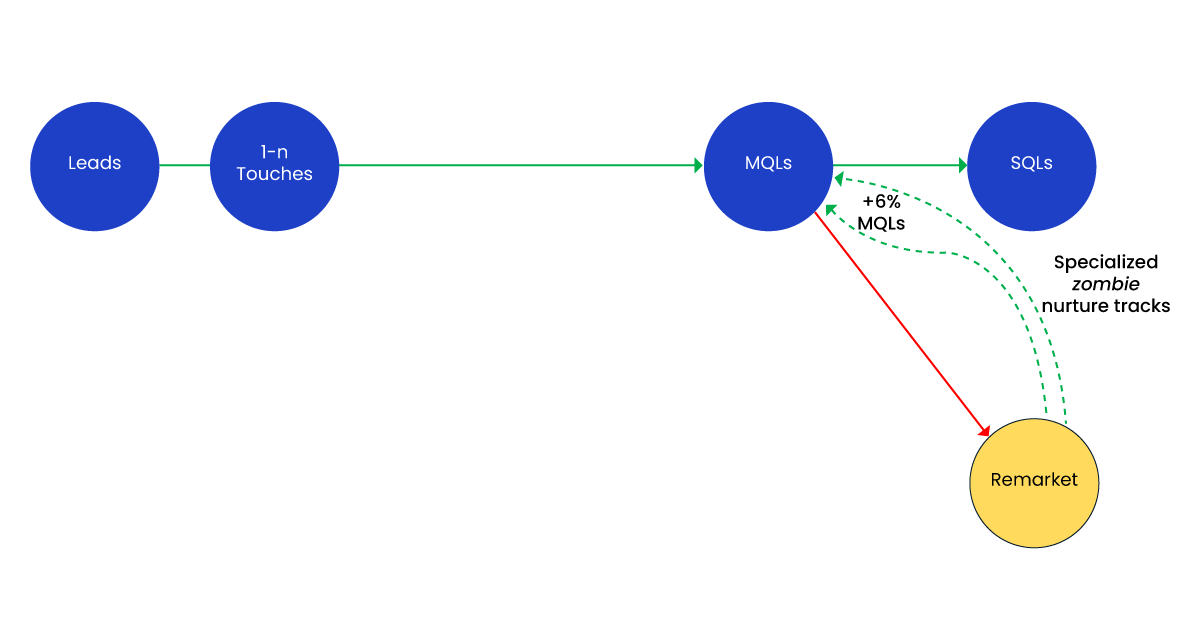

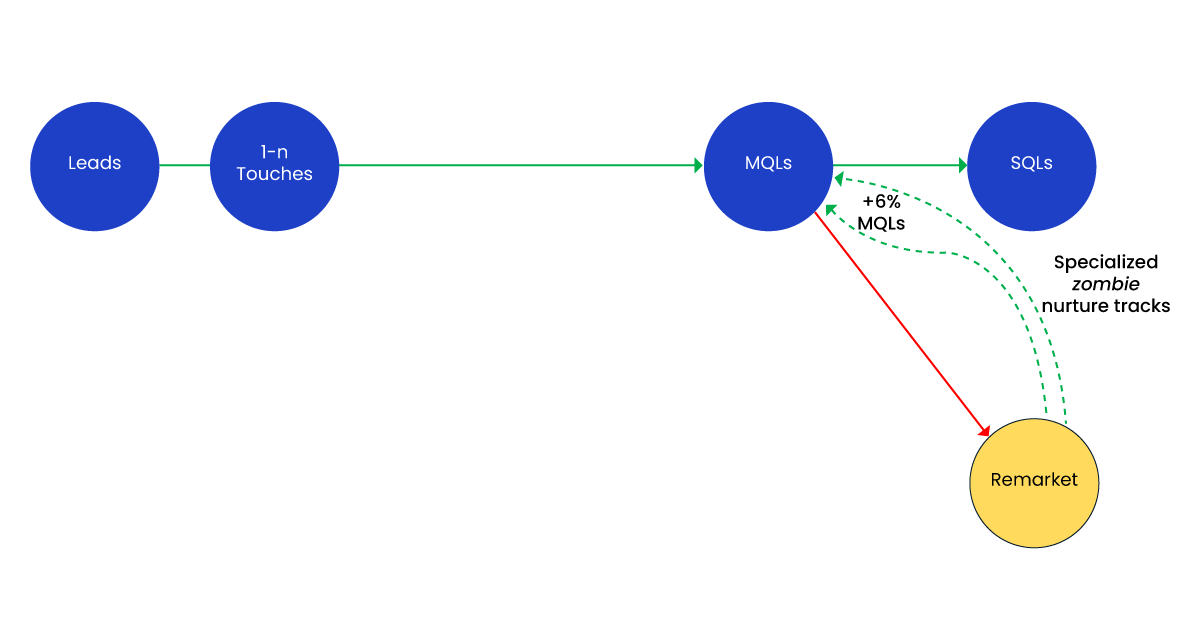

MQLs rejected for all of the above reasons except the last one can come back into contention in the future when they are ready to engage. In fact, if handled properly, these leads have the greatest likelihood amongst all stale leads for future conversion. By putting remarketed leads into specialized nurture tracks organized by the reason for exit, you can slow-nurture these leads with the right kind of educational content until they wake themselves up like zombies from the dead. The slow cadence is important – if you hit them too often and with the wrong content, they will unsubscribe.

Subsequent to the BigLittle analysis, our customer has utilized zombie nurturing to drive a 6% increase in MQL from their Remarket list as shown in column 3 of table 1.

Idle leads

Creating a connection with your leads is important to conversion. Just as important is maintaining it. In this case, a large volume of leads (83%) had turned completely cold and unresponsive with no apparent path to MQL. These ‘idle’ leads had a minimum threshold of 90 days of unresponsiveness, with an average age of 390 days. Here’s what the analysis uncovered:

| Title | Lead to MQL conversion rate | Median age of Lead | Average # of touchpoints |

|---|---|---|---|

| VP/CXO | 2% | >400 days | 1.2 |

| Director/Manager | 5.5% | 200-300 days | 3.5 |

| Admin/Analyst | 11% | < 200 days | 5.6 |

Clearly, understanding both the audience (lead profile and account profile) and the content that had failed to engage them is the first step to remediating the problem. In this customer’s case, leads belonging to different profiles were being nurtured with the same approach leading to a heavy dropoff in engagement, as shown in table 1.

The first part of the solution is to create different nurture tracks by segmenting sleeper leads based on their profile and their past engagement history, similar to what we discussed previously with remarketed leads. A curated selection of content assets with well-targeted messaging and personalized calls to action (CTAs) will be crucial to micro-nurture and ultimately revive some of these idle leads.

| Time to stage | Duration |

|---|---|

| Time to first touch for leads that eventually became MQL | 1.5 days |

| Avg time to MQL (excluding instant MQLs) | 52 days |

The second part of the solution here is pre-emptive. What can the customer do to prevent further recurrence of this issue? As shown in table 3 above, the duration for first touch is only 1.5 days for leads that became MQL. The duration to MQL is 52 days, not counting instant MQLs. This gives us a good barometer for when leads are starting to stagnate and provide an opportunity for agile course correction.

Subsequent to the BigLittle analysis, our customer has set up specialized sleeper nurture tracks as well as alerts for when active lead cohorts pass the first touch or MQL duration threshold. Since idle leads constitute the most common end state for leads, there is immense potential for recovery of leads from this state to MQL and beyond.

BigLittle Provides Lead Flow Analytics and Insights For The Modern RevOps Org

At BigLittle, we are helping define and build this future of RevOps. We are the Intelligence and Orchestration layer for RevOps teams and can track and triage all revenue processes end-to-end across marketing, sales and customer success operations. By working with and at a level above the operational tools, we can help RevOps teams to avoid alert fatigue and insight storms by streamlining revenue processes across sales, marketing, and customer success.

Get in touch with us to know more.